I’m already seeing the credit on my auto-pulled transactions, however QBO is mistakenly displaying it as a phone service bill, as opposed to the $800 (yay me) credit score towards my balance. Seeing the way to https://www.quickbooks-payroll.org/ enter Visa cashback in QuickBooks Online ought not to look like troublesome with these means. While you enter the cashback, make positive that the sum is true, or, greater than likely you may see monetary errors yet to be decided.

To enhance your credit score score, concentrate on paying down current money owed, making on-time funds and monitoring your score online to watch out for any errors. You should make an eligible purchase with your card to earn cash back. Cash-back charges usually range from 1% to 5%, so you will nonetheless pay for many of your buy out of pocket. Curiosity costs and even late payment charges can simply cancel out any cash-back rewards you obtain. The opportunity to earn money again may also tempt cardholders to spend more.

During one quarter, you could earn 5% cash back on all of your restaurant purchases. You can create a devoted account for monitoring cash-back rewards in each QuickBooks Online and QuickBooks Desktop. This motion permits you to categorize and monitor your cashback rewards individually from other income sources. In the Online adaptation of the QuickBooks programming, the Mastercard cashback prizes may be recorded. Presently, you wish to choose a payee, and after that incorporate the Bank Card Account.

Report Money Back Rewards In Quickbooks Online

Now you need to go to the element kind and enter the element as required, talk about together with your accountant if you’re uncertain concerning what to enter. First of all, After opening the QuickBooks, go to the left panel of the menu and click on on the accounting tab. After clicking on the accounting tab, you have to go to the Chart of Accounts.

There is little distinction in recording cash-back rewards in QuickBooks Online and QuickBooks Desktop. This article will give you insights into the method of tips on how to document cash-back rewards in both QuickBooks Online and QuickBooks Desktop. I respect you coming to the Community with your query about recording a cash again.

Welcome Bonus

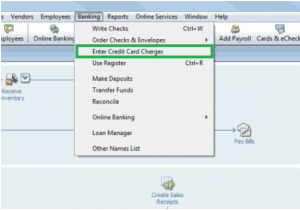

Simply got another Visa that offers me money again, a degree of the money I spend. At the point when I brought the discount trade into QuickBooks, I was confused almost about the place to put the refund. A little net research raised two methodologies for recording Visa monetary compensations in QuickBooks. Strictly Essential Cookie ought to be enabled always in order that we can save your preferences for cookie settings. Initiate the process, by opening the QuickBooks and clicking on Banking. The -40 I showed for revenue on the instance of the invoice, is telling QB to post a credit to revenue, a credit to revenue does enhance revenue.

- There is little distinction in recording cash-back rewards in QuickBooks On-line and QuickBooks Desktop.

- Strictly Essential Cookie should be enabled at all times so that we are ready to save your preferences for cookie settings.

- Your reminiscence must be sharp with these choices otherwise you’ll should set reminders to remain on high of categories as they change.

- The “best” technique is dependent upon the precise kind of rewards, your small business structure, and your accounting philosophy.

However, establishing the cashback rewards account and ensuring proper categorization of deposits and expenses to trace and monitor your rewards precisely is crucial. Accounting for bank card rewards isn’t always black and white. The “best” method depends on the specific sort of rewards, your corporation construction, and your accounting philosophy. However, a cash-back reward is considered blue business different income and shall be recorded in your balance sheet. It reveals the importance of recording cash-back rewards obtained from credit card bonuses.

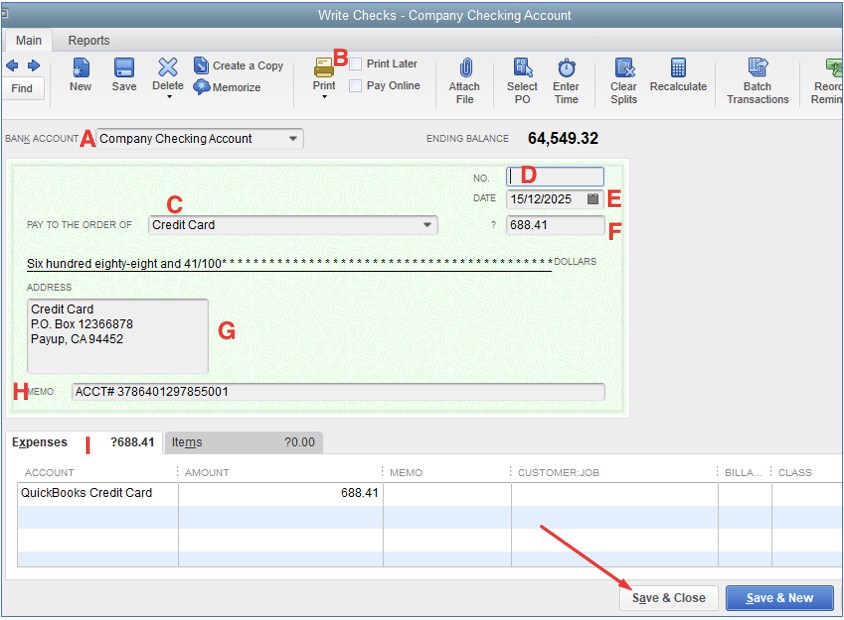

Since they begin out of your cost card organization, for example, American Express, the service provider could be American Specific. Directions to Report Payments – Funds to a Visa are simple, people however will very often make this more perplexing. An installment to a Mastercard is an trade of belongings, everything you’re doing is moving money out of your financial institution to your Mastercard. No service provider or consumer should be entered as you are not getting installments or paying anyone. If you want to enter a reputation, this is able to be a chance to utilize the QuickBooks ‘Different Name’ kind.

We believe everyone should be in a position to make financial selections with confidence. We suggest solely spending an amount you feel snug with paying back in full at the end of the month. This possibility might help you avoid feeling pressured to spend in areas that don’t make sense on your monetary wants and lifestyle. Some playing cards permit you to redeem present cards to well-liked eating places and retailers with your cash-back rewards. We’re at all times around and able to help with future considerations about recording cash-back rewards in QuickBooks Online.

At All Times examine the phrases and situations of your bank card settlement to guarantee you perceive the way to begin incomes money back with the precise card. Some mechanically provide you with money again whenever you make a purchase order. Other cards that use a tiered rewards system could require you to activate a selected cash-back provide first. For instance, in case your card pays a flat cash-back fee of 1.5% and also you spend $100, you’ll earn simply $1.50 in money back, that means your total out-of-pocket expense for the purchase shall be $98.50. Earning cash again can be easy and is smart if you use a credit card to make regular purchases anyway. If you’re seeking to reward yourself with further money, it’s worth contemplating no much less than one high quality cash-back card to maintain in your wallet.