Small nonprofits and startups would possibly find QuickBooks Nonprofit or Aplos Accounting to be cost-effective and user-friendly decisions. Aplos is an all-in-one cloud-based platform designed for nonprofits and churches that want more than primary bookkeeping. It combines fund accounting with donation tracking, budgeting, payroll, and event management—making it particularly useful for faith-based organizations managing multiple funds, ministries, or campaigns. Wave is a best choice for small to mid-sized nonprofits with budget issues. It provides essential options like income and expense monitoring and invoicing at no cost.

Budgeting And Financial Planning Tools

Zoho Books excels at collaboration—you can delegate as many tasks as you have to different organization members. Volunteer-run organizations don’t always want the identical bells and whistles as other nonprofits. Money Minder has created a fund accounting software program focused towards these smaller organizations and doesn’t supply an excessive quantity of or too little. Explore prime nonprofit software for donor administration, fundraising, and grant tracking best accounting software for nonprofits. Evaluate features, pricing, and evaluations to search out the best match for your nonprofit. They’re too big for small-scale solutions but not giant enough for enterprise-level software program.

Then map your budgets, bills, and earnings into your new tool’s structure. Most platforms provide import templates or onboarding help to simplify the switch. IYou know your way around a spreadsheet, however at some point https://www.quickbooks-payroll.org/, Excel alone isn’t sufficient to deal with the distinctive financial needs of your rising nonprofit.

Serenic Navigator: Advanced Budgeting And Grant Administration

Additionally, a system ought to permit role-based access to manage who can view and edit financial knowledge. Discover the highest funding sources for nonprofit organizations and professional tricks to succeed along with your chosen mix. Simple tools like Wave or QuickBooks could be up and operating in a day, while more advanced platforms like Sage Intacct could require workers training and knowledge migration planning. Utilizing multiple accounting platforms can lead to errors or information inconsistencies. Instead, look for tools that integrate together with your CRM, donation platform, or payroll system so every thing stays in sync. Begin by cleansing up your spreadsheet data—remove duplicates, fix formatting, and organize categories.

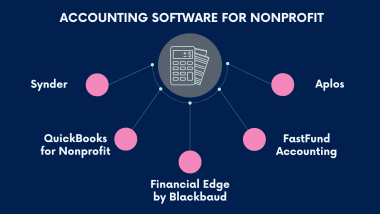

Evaluate top instruments like QuickBooks, Xero, Aplos, and extra — primarily based on pricing, features, and nonprofit-specific support. While you’re optimizing your accounting processes, consider how you can improve other aspects of your nonprofit’s operations. Zeffy offers a 100% free fundraising platform for nonprofits to save heaps of unnecessary software program and transaction prices. Your accounting software program should integrate seamlessly with current instruments like donor management techniques, CRM platforms, or fundraising software. Using clever reporting instruments, nonprofits can create specific financial statements. This not solely helps with compliance but in addition boosts operational efficiency by figuring out tendencies and improving processes.

This distinctive financial landscape calls for software that handles conventional accounting tasks and the complexities of grant tracking, donor administration, and regulatory compliance. Sage Intacct is a nonprofit accounting software primarily based entirely in the cloud. This means nonprofits can entry their monetary information from anyplace. In addition to basic accounting features like a basic ledger and money administration, Sage Intacct additionally provides an automatic fund, grant, income, and billing process. They additionally embrace easy-to-use reporting and dashboards to make auditing extra accessible and cheaper. QuickBooks provides nonprofits the ability to perform primary nonprofit accounting features.

When choosing accounting software program for nonprofits, it’s crucial to contemplate a number of essential features. Whereas the size of your organization could influence your selection, some features, such as activity monitoring and reporting and donor administration, are important regardless. Nonprofit accounting software program usually includes advanced budgeting instruments that permit organizations to create, monitor, and regulate budgets with ease. Many platforms additionally support situation planning and monetary forecasting, serving to nonprofits put together for modifications in funding or expenses.

Its versatility shines in its adaptability to the unique requirements of small nonprofit organizations. Right Here, we’ll explain the best accounting software program for nonprofits and focus on the top options and performance, pricing plans, and the pros and cons of every software program. Some choices would be higher suited to smaller nonprofits with fundamental needs and others for rising organizations with many transferring elements. Since QuickBooks was also made for non-accountants, it’s easy for first-time nonprofit bookkeepers to get a handle on nonprofit funds.

These nonprofit accounting software program choices ought to help you choose the right one on your group. Current versions of QuickBooks must as a substitute be personalized to allow nonprofit-specific functionality. For organizations, this requires savvy QuickBooks experts able to customizing the software program to fulfill their organization’s explicit wants.

An organized workflow results in more environment friendly and error-free financial administration. QuickBooks is not free for nonprofits, however significant reductions are available. Through TechSoup, eligible nonprofits can access QuickBooks Online for a minimal annual payment.

- They also contemplate the significance of integration with current techniques and the software’s capability to grow with the organization.

- While the dimensions of your group could influence your alternative, some options, corresponding to exercise monitoring and reporting and donor administration, are essential regardless.

- If you’re ready to take the subsequent step, start by exploring free trials, watching demos, and involving key stakeholders in the decision-making course of.

- Plus, QuickBooks’s cellular accounting app is at least as user-friendly as its software—so should you plan to do a lot of on-the-go donor management or monetary monitoring, QuickBooks is one of your greatest options.

Xero is a cloud-based accounting software that provides an easy-to-use platform with highly effective features for small to mid-sized nonprofits. Known for its simplicity and integration capabilities, Xero is an excellent selection for organizations looking to streamline their financial administration processes. Wave is a free accounting software for small nonprofits with easy bookkeeping wants. Whereas it’s not constructed particularly for nonprofits, it offers important tools like revenue and expense tracking, invoicing, and fundamental reporting—all at no cost. For lean teams or newer organizations simply getting began, Wave is an easy method to stay organized without stretching your budget.